do nonprofits pay taxes on rental income

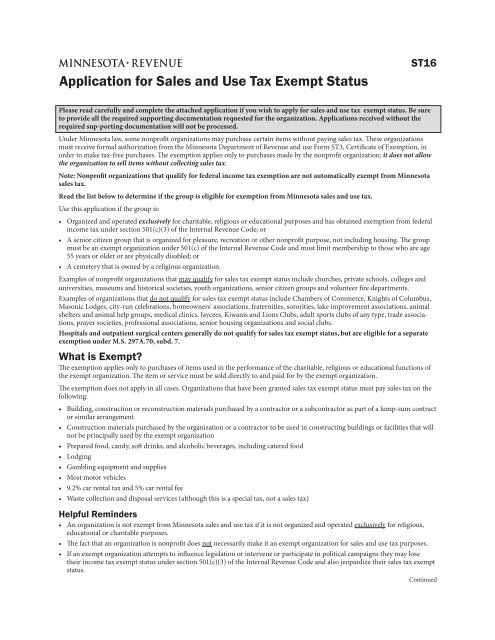

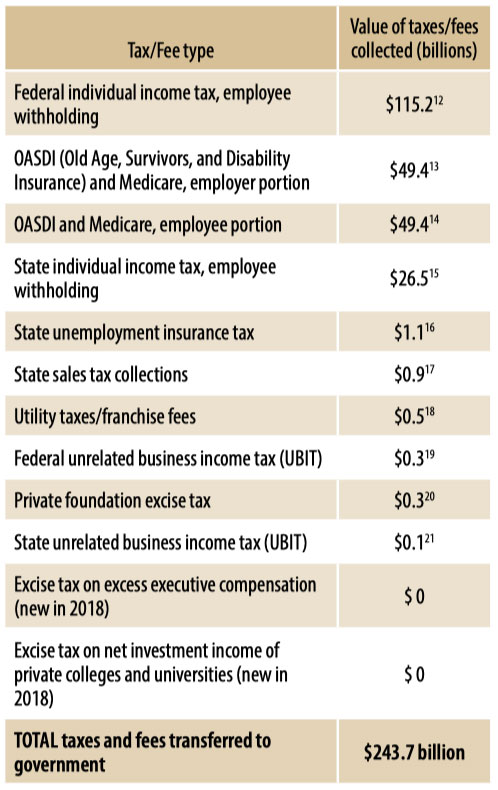

Nonprofits are not exempt from property taxes and they are required to pay payroll and other taxes to the government. Yes nonprofits must pay federal and state payroll taxes.

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

A non-profit organization NPO as described in paragraph 149 1 l of the Income Tax Act.

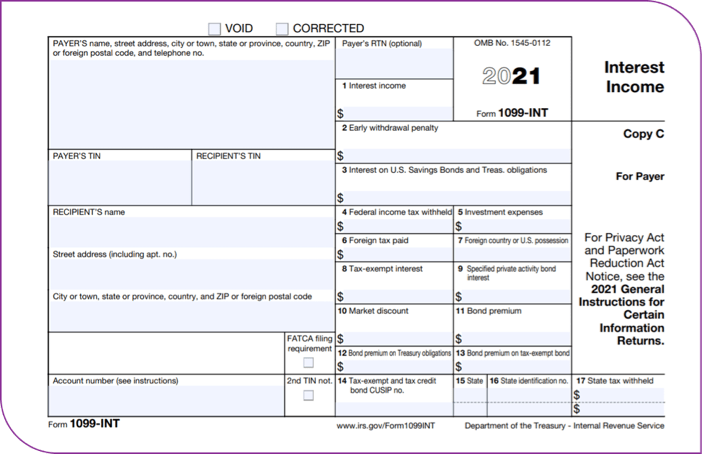

. John and Abram are British residents and are permitted a UK personal allowance of 12500. Your recognition as a 501c3 organization exempts you from federal income tax. The IRS defines unrelated business income UBI as income from a trade or business regularly carried on by a nonprofit organization that is not.

Non-profit organizations are not exempt from paying all taxes. What taxes do non-profits pay. This means the rental income investment income and many other forms of income that would be tax exempt for other organizations are not tax exempt for 501c7 9 and 17.

But if you rent out a property for only 14 days or fewer out of. Just because you have a tax-exempt status it does not mean that youre well tax. While most US.

Some nonprofits are tax exempt meaning they do not have to pay federal corporate income tax. June 30 2021. Do nonprofits pay payroll taxes.

This guide is for you if you represent an organization that is. Organizations granted nonprofit status by the Internal Revenue Service IRS are generally exempt from tax they must pay some types of taxes under certain. But determining what are an.

An agricultural organization a board. However this corporate status does not automatically. In general those who rent out a property for 15 days or more out of the year must pay taxes on rental income.

Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions. Some cities require that all property owners including. In this matter there is no UK.

If you are 65 years old or older and your net income the previous year wa s 10000 or less you qualify for a 4000 property tax. The IRS reports that organizations that hire employees must pay payroll and. While nonprofits are generally tax-exempt they must pay income tax when operating outside the scope of their exempt purposes.

Report rental income on your return for the year you. Their allowances fully cover the annual rent of 25000. Published on September 4 2014.

Its worth noting though that not everyones personal allowance will be the same as it can. Did you know that sometimes nonprofits must pay income tax. When the IRS reclassifies rentals as not-for-profits the rental income.

Ubti Reporting Requirements For Partnerships And S Corporations

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

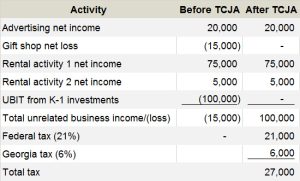

Taxing Nonprofits Changes In Unrelated Business Income Tax Pro Center Intuit

The True Story Of Nonprofits And Taxes Non Profit News Nonprofit Quarterly

Best Rental Property Spreadsheet Template For Download

Rental Property Loans And Grants Home Headquarters

Irs Form 990 Filing Instructions And Requirements For Nonprofits

Comprehensive Guide For Nonprofit Statement Of Activities Jitasa Group

Foundations Of Unrelated Business Income For Religious Organizations Ppt Download

Where Does The Money Go The Big E Is A Nonprofit That Took In More Than 17 Million In Revenue In 2013

Nonprofits And The New Omb Uniform Guidance Know Your Rights And How To Protect Them National Council Of Nonprofits

Nonprofit Organizations Virginia Tax

Tax Information Nonprofits Renting Extra Space Church Facility Solutions

Publication 587 2021 Business Use Of Your Home Internal Revenue Service

Dor Unemployment Compensation State Taxes

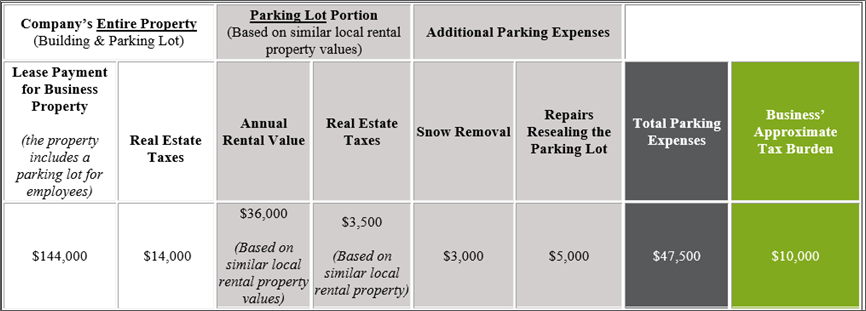

The Cost Of Providing Employee Parking Just Went Up

Company Tax Breaks For Nonprofit Donations

How Changes To Unrelated Business Income Tax Ubit Will Affect Nonprofits Smith And Howard Cpa